400,000 bpd crude oil deficit, despite vast reserves Nigeria at risk of partial implementation of 2024 budget – IPPG Chairman

… says competitive fiscal regime being negotiated with Shell, Total Energies, ExxonMobil, Chevron, to unlock 700,000 bpd in short, medium term

Oredola Adeola

Nigeria’s daily production of 1.3 million barrels of crude oil and 8.5 bcf of natural gas, boasting over 37 billion barrels of proven crude oil reserves and 207 trillion cubic feet (tcf) of proven gas reserves, along with 600 tcf of contingent gas reserves, puts the country at risk of partial implementation of national budget due to 400,000 bpd shortfall from the forecasted 1.78 million bpd, this is according to the Independent Petroleum Producers Group (IPPG).

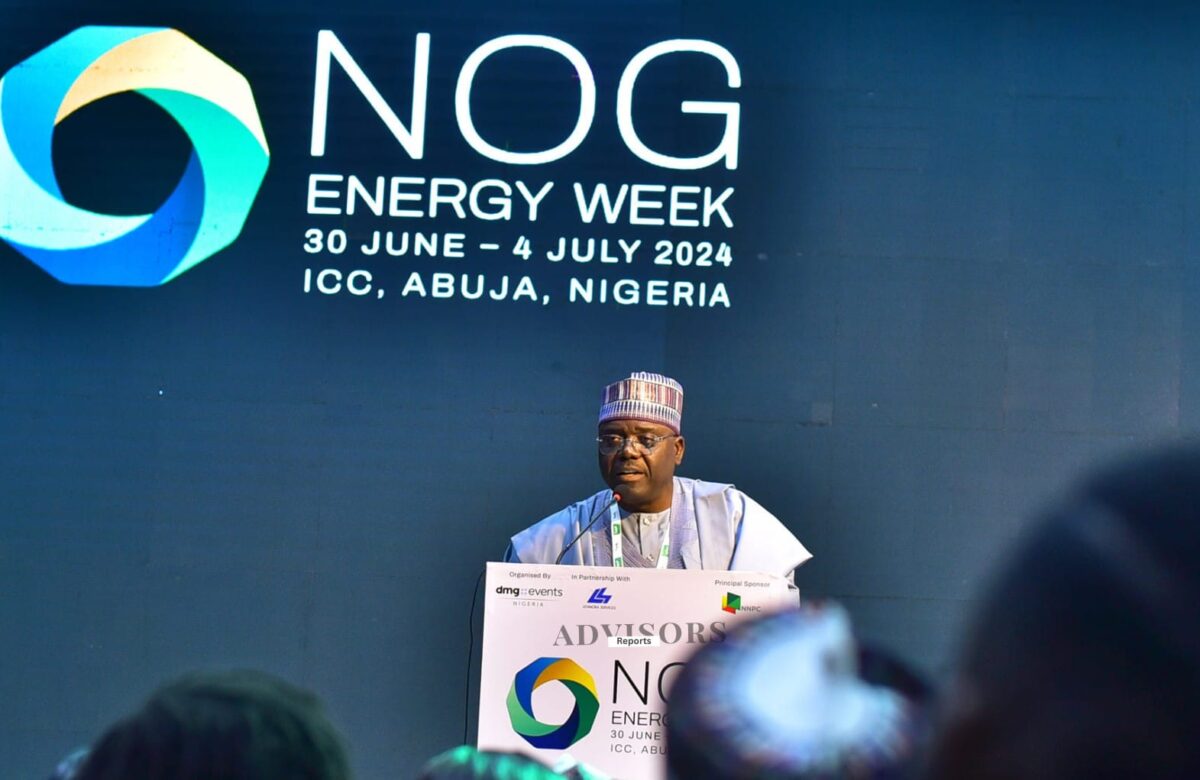

Abdulrazaq Isa, Chairman, IPPG Independent Petroleum Producers Group (IPPG), made this observation while delivering an industry keynote address at the ongoing 2024 NOG Energy Week.

According to him, despite the swift progress on the implementation of President Bola Tinubu’s executive orders and directives, which has untangled issues in some of the long-overdrawn IOC divestment transactions –and some tangible results within a relatively short time, the industry is in dire need of extraordinary focus to mitigate the genuine concerns on its long-term sustainability.

He emphasised that producing about 1.3 million barrels of oil and 8.5 bcf of gas today, way below the country’s capacity as a nation and by all globally acceptable standards.

“This reserves to production ratio is extremely low and a clear indicator that the industry is in a dire situation.

“This trend in production portends another frightening dimension when we consider that in the not-too-distant future our overall installed domestic refining capacity, currently closing in on about 1.2million barrels per day, may soon outstrip our current crude oil production level with the risk of Nigeria finding itself in a position where it is unable to meet its domestic refinery crude demand or even become a net importer of crude oil, God forbid,” Isa said.

The Chairman has therefore hinted that it is against this scary backdrop that the IPPG is calling for urgent measures to be undertaken by all relevant stakeholders to immediately arrest this dwindling production level and under-investment.

He has also suggested focus on the priority areas, including the immediate conclusion of all pending IOC divestment transactions.

Isa said, “IPPG strongly advocates that our member companies – Seplat, the Renaissance Consortium and Oando – have the proven track record to successfully take over and manage these onshore and shallow water assets to realise incremental production in the region of 100,000 – 200,000 barrels of oil and over 1.5bcf of gas per day within 24 months and well over 500,000 barrels of oil per day in the long term.

IPPG believes the timely approval of these IOC divestment transactions will also be a clear signal capable of restoring global investor confidence in Nigeria in an era of competing global investment destinations in Africa and very limited access to capital.

He also recommended the urgent need to address deepwater development and production.

He stated that untangling issues around deepwater development, particularly in terms of the competitive fiscal regime being negotiated with Shell, Total Energies, ExxonMobil and Chevron, has the potential to unlock incremental production of 700,000 barrels per day from this terrain in the short to medium term.

Enabling deepwater development will attract significant economic benefits as Nigeria has one of the world’s largest untapped deepwater resource bases.

The IPPG Chairman also recommended the adoption of a national value-retention strategy.

According to him, Nigeria’s domestic crude oil refining and petrochemical capacity must be sustained primarily from our domestic crude oil and gas production in order to transform our country into a net exporter of refined petroleum and petrochemical products that will lay a strong foundation for the rapid industrialization of the Nigerian economy.

He added that it is imperative to grow our daily production to 2.5 million barrels of oil and 10 bcf of gas in the near to long term to ensure we are able to meet our domestic refinery and petrochemical demands and export commitments to generate the much-needed foreign exchange earnings for macro-economic stability.

Another solution recommended was the development of Nigeria’s gas resources to catalyse economic growth and complement the decarbonisation drive.

Issa said, “Nigeria’s vast gas resources must be exploited with immediate focus placed on restoring production to existing installed LNG capacity and expanding production (FLNG). In addition, we must expand domestic gas utilization (Gas-to-Power; Gas-Based Industries) by investing heavily to address the gas infrastructure deficit facing us today.

“The International Oil Companies will lead the charge on export gas while IPPG members will drive the domestic gas agenda led by NNPCL,” the Chairman said.

He further emphasised that those priority areas provide the most realistic and sustainable pathway towards meeting our national long term production aspiration of 4 million barrels of oil per day and 13 billion cubic feet of gas per day.

“Consequently, as a matter of national importance, Nigeria must act fast and hasten the pace of recovery across the entire industry, even if it means President Tinubu declaring a state of emergency in the oil and gas sector.

” We must be seen to do everything possible to unleash the industry,” the IPPG Chairman said.

He noted that unlocking this incremental production is achievable only through collaboration and commitment between the industry regulators (NUPRC and NMDPRA) and industry operators (NNPCL, OPTS and IPPG) and this must be done for the sake of our country.