Global Mine 2024 Report: PwC urges top 40 mining companies to enhance transparency, impact reporting

… percentage of completed mining deals on critical minerals rose to 40% in 2023 from 22% in 2019

… lithium, copper dominate 70% of 2023 deal volume

Oredola Adeola

As copper and lithium dominated over 70% of the deal volume recorded in 2023, PricewaterhouseCoopers (PwC) has urged the world’s top 40 mining companies to adopt innovative and transparent methods for measuring and reporting their impacts, facilitating more informed capital allocation decisions with stakeholders amidst the transition to a low-carbon future.

This was the highlight of the virtual launch of the Global Mine 2024 publication reviewed by PwC Africa’s mining experts, Andries Rossouw, PwC Africa Energy Utilities & Resources leader, and Gifty Appiah, PwC Ghana, Associate Director, on Tuesday.

The report revealed that the world’s top 40 mining companies, which have been leading the transition to a low-carbon future and supplying critical materials for infrastructure and consumer demand, must harness technology (with specific reference to artificial intelligence) to maintain and increase productivity throughout the mine life cycle.

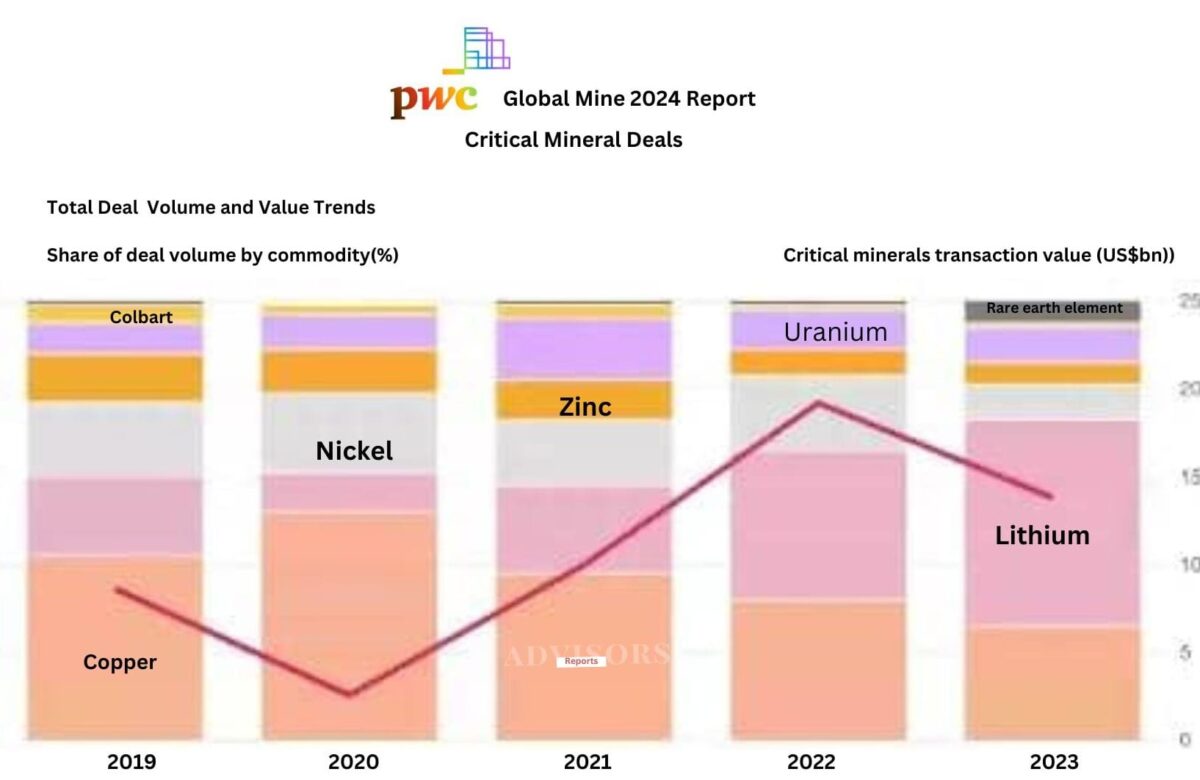

It also revealed that the percentage of completed deals involving the Top 40 companies and focused on critical minerals, soared to 40% in 2023, up from just 22% in 2019.

This surge, according to the report, underscored the increasing importance of critical minerals in driving mergers and acquisitions (M&A).

It emphasised that copper and lithium were at the forefront of these transactions, dominating over 70% of deal volume, a slight increase from 2022.

The Global Mine Report 2024 revealed that the trend highlights the growing strategic focus on these essential resources as the industry adapts to evolving market demands.

According to the world’s leading advisory firms, the world’s top mining companies have an important story to tell.

The PwC Global Mine 2024 publication stated, “These companies, which are at the forefront of driving a low-carbon future and supplying essential materials for infrastructure development and consumer products, need to provide investors with a useful gauge that goes beyond their returns.

“Capital allocation decisions can be directed for maximum impact through the prism of a broader lens.

PwC further stated that leading mining companies that have become a force for good, sharing the value and critical to life in the 21st century can be more transparent to other stakeholders – communities, unions, and the wider public – by informing them about their views of the industry.

The publication revealed that the activities of these companies have largely remained obscured, hidden from the view of both the public and investors.

According to PwC, this underscores the need for miners to provide greater transparency to remain profitable and competitive in a rapidly changing world.

The 2024 report also identified urban mining, or recycling as veins the Top 40 mining companies need to tap.

It emphasised that that approach often produces commodities with a significantly reduced environmental footprint which can command a green premium.

The report also emphasized the critical importance for mining companies to capitalize on the opportunities presented by Artificial Intelligence (AI).

It contended that AI must be effectively leveraged to sustain and augment productivity across the entire life cycle of mining operations.

PwC revealed that AI adoption can significantly advance productivity levels within the mining sector. By unlocking AI capabilities, mining operations can not only streamline processes but also build upon substantial strides already achieved in health and safety standards.

The report also affirmed that without mining, there will be no AI and the game-changing impact it will have on other industries and society more widely.

It said, “The semiconductor chips that AI applications require contain metals such as copper, zinc, and gold.”

Andries Rossouw, PwC Africa Mining Leader, during the document review, noted that AI-driven supply chain optimization will be a major driver of global mining resources.

He urged mining companies to invest in renewable energy sources to reduce emissions and increase profits through cheaper energy costs.

Meanwhile PwC in the Global Mine 2024 publication stated that amid a new and ever-changing landscape, old-fashioned Mergers and Acquisitions (M&A) remain a crucial strategy for miners to maintain their competitive advantage even while it grows in new terrain in response to emerging demand.

It also stated that sustainability factors and considerations are key to such transactions.

“Investors are not just interested in the current bottom line – they want insight into how a company will perform and look in the future.

“Recognizing this, mining companies are increasingly forming alliances beyond traditional boundaries as they seek the technical skills they lack and collaborate with governments to create enabling environments.

While attempting to navigate this changing and challenging field, PwC revealed that the Top 40’s financial

performance in 2023 was squeezed by falling commodity prices and rising costs.

It stated that revenue fell over 6% even as production of key commodities rose.

PwC in the report said, “Containing costs through productivity gains using the emerging technical tools available, with an eye to a rebound in commodity prices, will help to position the industry for the future.

The firm therefore emphasised that a sustainable industry would enable it to fulfill its vital role in providing critical minerals to sustain life. Earth’s endowment of natural resources is finite.

“There is no better time than now for the Top 40 to maximise their positive long-term impact while positively sharing with all stakeholders,” Global Mine 2024 publication revealed.